Welcome back!

So, here it is, my planning stage: Money!

I’ve had so many thoughts flying around my head about what I can do and I have read so many suggestions online.

As I mentioned in my last post, I have to pay for the car. I pay £270 a month and I have 17 more payments to make, after that I have a final amount of £11,000 to pay. My intention when first getting the car was to take a loan out for the final sum. However, I don’t know for how long I could be gone and additionally, upon my return I don’t know if I will get a job that pays well enough to secure a loan. Ideally, I’ll try to pay-off the car, so I need about £17,000… easy right.

Identifying the problem

Money is my big issue.

- I seem to struggle with saving

- I just need more of it

I am now going to keep an eye on my spending and set myself limits.

I will still enjoy life, but I need to get passed my FOMO (fear of missing out) and say ‘no’ to going out when I’ve hit a set spend limit.

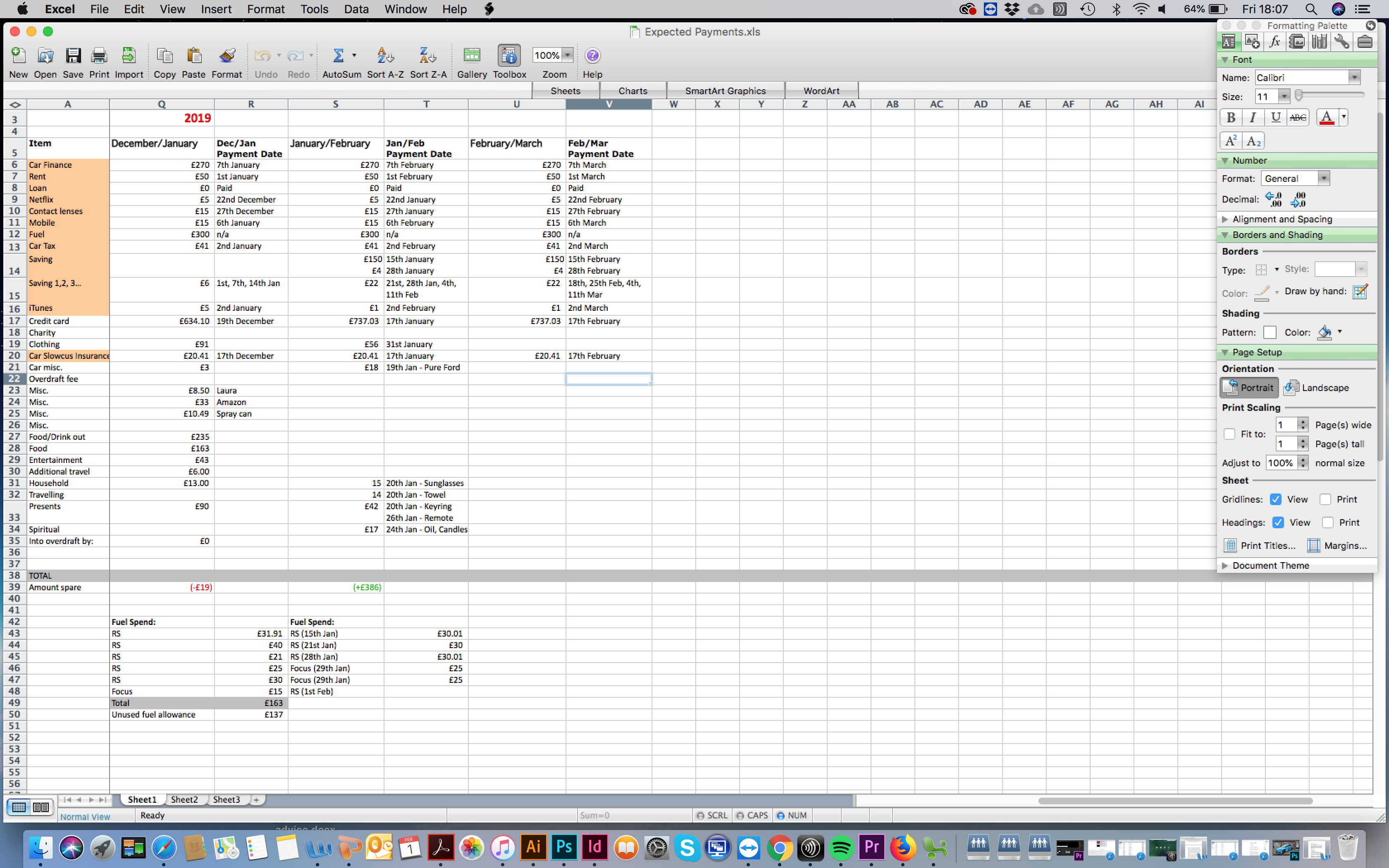

I have set-up a spreadsheet with all of my spending. Mandatory payments, such as the car loan, phone plan, rent, car tax/insurance, fuel and contact lens plan, have been highlighted. I now literally input EVERYTHING!

| Spending problem | Spending solution |

| I go to the supermarket each Monday on my lunch break I spend more than I need, plus I have food waste at the end of the week. | Buy the bread and filling in the home food shop, pre-make the sandwiches and freeze them… Nothing going to waste. |

| I can see that I spend a lot on eating out. I find that I’ll often treat friends to drinks/food, but don’t get it in return, so I end up spending a lot. | As much as I like to treat other people, all of my friends earn more than me, so I don’t need to do it. I need to think before I offer. |

| Buying clothes. My ex used to say my clothes were frumpy a lot and that has stuck with me, so I try to keep to the latest trend. | Only buy clothes when I get vouchers or buy one piece of clothing a month at most. |

| Spending too much money on fun/entertainment. | Setting a £50 spend limit p/m (e.g. cinema, nights out, dinner etc.). |

Post tax, NI, and student loan, I’m paid £1,400 a month (net). So my plan is to cut a lot and if I can, try to only spend £500-£600 a month.

Improving my income.

Job wise, I’ve put in some serious thought.

Sales job:

Getting a sales job and working hard to make commission could heavily support the saving for the trip. Sales is not my thing and I know I would hate it, but it’s something I can so. As I like and have knowledge about cars, this would be the sales job where I think I would have the most success. I’m looking for a role where I could earn at least £30-£35K a year.

Second full-time job:

This would be a crazy one, but would give me a high secure earning potential. It wouldn’t be permanent and at most a year to a year and a half. The second job alone would help me to pay off the car, with some money for savings left over. That would then free-up money from my other full-time job to save, save, save! This would be gruelling and I might not be able to sustain it for as long as I hope.

Part-time job:

The part-time job would boost the savings, not as much as another full-time job, but that might not be something I can handle. A part-time job would have to happen for whatever outcome if I don’t have the two full-time jobs.

Saving

A suggestion for saving I read on a Facebook travel group was to do the ‘1, 2, 3…’. This is where each week of the year money is saved.

Week 1 = £1

Week 2 = £2

Week 3 = £3

…And so on…

Week 52 = £52

This should give me a saving of £1,378 without really trying.

Another suggestion I read online is to transfer my monthly pay out of my account and only leave what I want to spend for the month. I’m thinking of spending £500-£600 a month (including mandatory payments), so I’m going to transfer £900 out and hope it can last.

I am also going to trawl through the house to find anything that I can sell. Unfortunately, my dad passed away in 2015, but my mum has been kind enough to give me his old motorcycle clothing to sell towards funding the trip.

I’m somewhat a hoarder and always keep things in case they are useful in the future, these are things I can sell.

I am an open book, so if there’s any information that I haven’t included and you would like to know, please contact me and I will update the post. Additionally, if you have any advice or suggestions then they are also very welcome.

It’s hard to find posts where you can gather information to compare. Lots of posts give you advice about how they saved for travelling, which is great, but it’s hard to apply it personally when you don’t have much other information from behind the scenes. While I am here to tell my story, if I can help anyone else in the same position throughout this process then that is a bonus.